Is there good profit of Chinese listed apparel companies in Q1 2024?

Chinese listed apparel companies have generally released their first-quarter reports. Whether the performance is "impressive" and or exceeding expectations have become the focus of attention on the market. This article selects 12 major companies as samples, providing a glimpse into the overall situation.

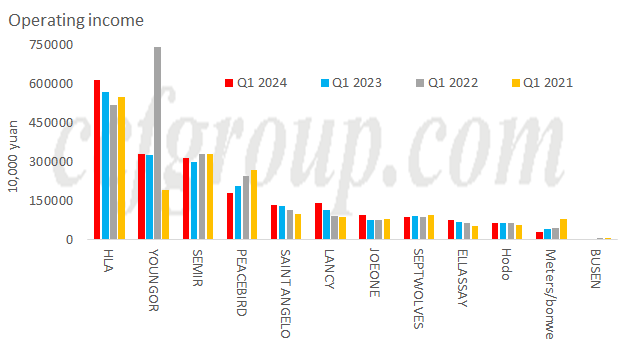

In the first quarter, HLA had the highest revenue of 6.177 billion yuan, a year-on-year increase of 8.72%. Youngor and Semir ranked second and third respectively, with revenues of about 3.311 billion yuan and 3.139 billion yuan, with year-on-year growth of 1.4% and 4.58% respectively. Meters/bonwe and Busen ranked last, with revenues of 279 million yuan and 36 million yuan respectively, showing year-on-year decreases of 31.38% and 14.84%.

The total revenue of the 12 companies in the first quarter was 20.733 billion yuan, a year-on-year increase of 4.17%. In terms of revenue growth rate, 7 companies saw year-on-year growth, while 5 companies including Peacebird, Septwolves, Hodo, Meters/bonwe, and Busen saw year-on-year decline. Meters/bonwe saw the largest decrease, while Lancy saw the largest increase.

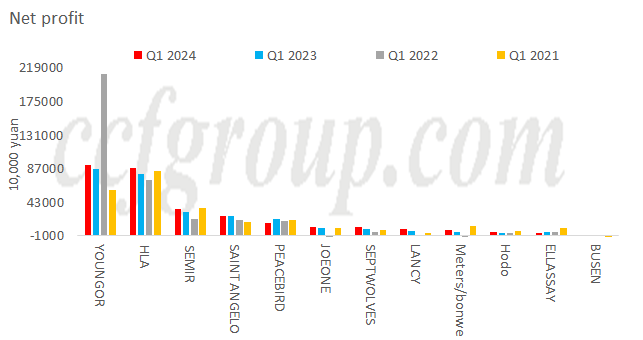

Youngor had the highest net profit at 927 million yuan, a year-on-year increase of 6.86%. HLA and Semir ranked second and third, with net profit of 887 million yuan and 346 million yuan respectively, with year-on-year growth of around 10.4% and 11.4%. Ellassay and Busen ranked last in net profit, with 29.195 million yuan and -7.9966 million yuan respectively, showing year-on-year decrease of 38.25% and 289.49%.

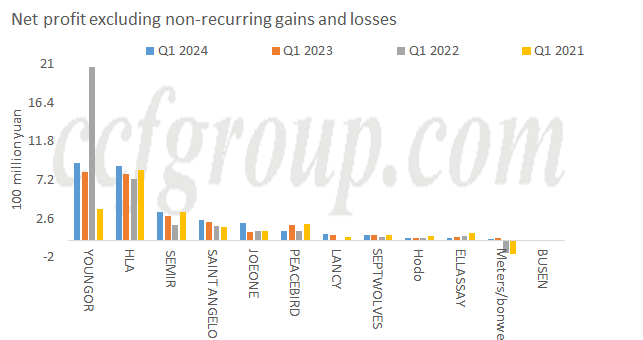

In terms of non-recurring net profit (net profit excluding non-recurring gains and losses), Youngor had the highest at 920 million yuan, a year-on-year increase of about 14.1%. HLA and Semir ranked second and third, with 877 million yuan and 338 million yuan respectively, showing year-on-year growth of around 10.87% and 15.75% respectively. Meters/bonwe and Busen ranked last, with 7.969 million yuan and -8.0107 million yuan respectively, showing year-on-year decrease of 61.8% and 306.32% respectively.

In summary, the total net profit of the 12 companies in the first quarter was 2.996 billion yuan, a year-on-year increase of 6.13%, and the total non-recurring net profit was 2.876 billion yuan, a year-on-year increase of 10.25%. Busen recorded losses in both net profit and non-recurring net profit, while the remaining 11 companies all achieved profits.

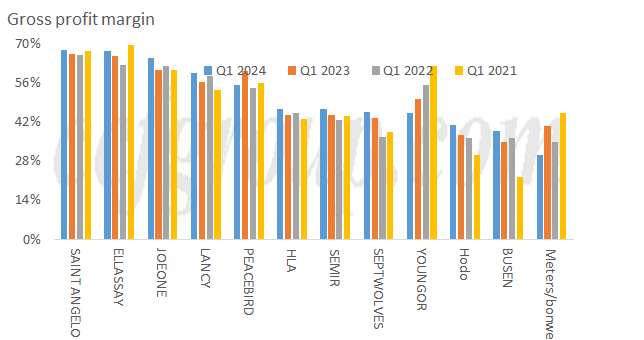

In terms of gross profit margin, Saint Angelo ranked first at 67.8%, followed by Ellassay and Joeone, with 67.26% and 64.98% respectively. Busen and Meters/bonwe ranked last, with gross profit margin of 38.61% and 30.27% respectively.

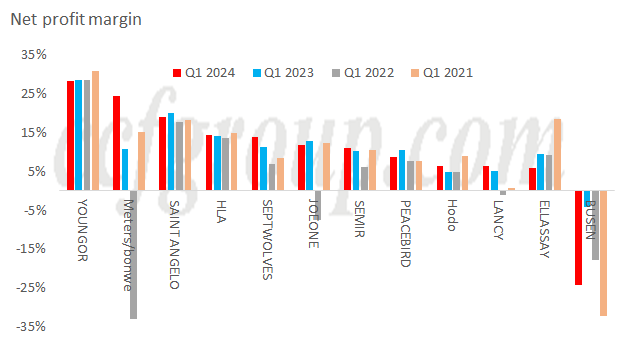

Regarding net profit margin, Youngor ranked first at 28.27%, followed by Meters/bonwe and Saint Angelo at 24.4% and 19.04% respectively. Ellassay and Busen ranked last at 5.95% and -24.15% respectively.

In the first quarter, the average gross profit margin of the 12 companies was 50.7%, a year-on-year increase of 0.8%, and the average net profit margin was 10.5%, a year-on-year decrease of about 5.7%.

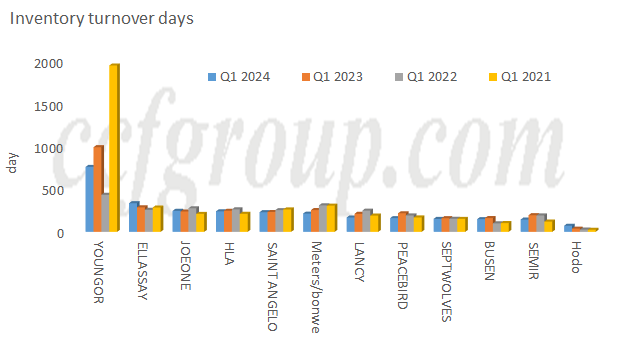

In terms of inventory turnover days, Youngor ranked first at 758.85 days, a year-on-year decrease of 23.27%. Ellassay and Jonone ranked second and third respectively, with 335.07 days and 245.57 days, showing year-on-year increases of 16.79% and 3.28% respectively. Hodo had the lowest at 70.98 days, a year-on-year increase of 88.28%. In the first quarter, the average inventory turnover days of the 12 companies was 238.53 days, a year-on-year decrease of 11.27%.

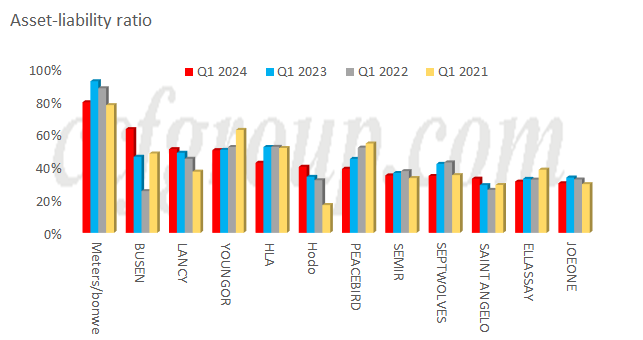

In terms of asset-liability ratio (total liabilities/total assets*100%), Meters/bonwe ranked highest at 79.04%, with Busen and Lancy Share ranking second and third at 62.8% and 50.66% respectively. Jonone had the lowest at 30.05%. In the first quarter, the average debt ratio of the 12 companies was 43.9%, a year-on-year decrease of 2.46%. Generally, a lower asset-liability ratio indicates a relatively strong debt repayment ability, but it is not necessarily better, and controlling it within the range of 40-60% is relatively favorable.

In conclusion, from multiple perspectives, the overall development of the 12 companies in the first quarter was good, with positive average growth for both revenue and profit. Apart from Busen's losses, the remaining 11 companies all achieved profits. Except for the high asset-liability ratios of Meters/bonwe and Busen, the remaining 10 companies were basically in the range of 30-50%, which is relatively reasonable.

However, the gross profit margin of the 12 companies is relatively high, ranging from 30% to 67%, while the net profit margin is between 5% and 20%, showing a significant decrease. This reflects: (1) significant differentiation among brand enterprises, with fierce market competition and obvious cost pressures; (2) it is not difficult to see the changes in market demand and the confusion during the period of enterprise transformation. How to adapt to new demands and models, and how to meet the personalized taste pursuit of more consumers are questions that the apparel companies need to deeply consider.

- Top keywords

- Cotton Price

- Cotton Futures Price

- Cotton Futures

- CZCE

- PTA Futures Price

- Chemical Fiber

- Polyester Prices

- Wool price

- PTA Futures

- Shengze Silk

- China

- Yarn Price

- price

- China Textile City

- Fibre Price

- Benzene Price

- Cotton

- Index

- Cotton Index

- PTA

- fabric price

- NYMEX

- Top 10

- textile industry

- Spot Cotton

- Cotton Yarn

- Polyester Price

- Futures

- PTA Price

- cotton yarn price